"IGNORE THE MARKET NOISE. TRUST YOUR ALGORITHMS. ACHIEVE SUPERIOR RETURNS."

WHAT WE DO OUR VALUES OUR EDGE OUR RESULTS OUR HISTORY MANAGEMENT

WHAT WE DO Mobilus Fund Management uses a rule based, long-only active trading strategy, based on proprietary quantitative algorithms to invest in large-cap stocks at Stockholm stock exchange through our Mobilus Scandinavian Focus Fund. The strategy is based around the principles of swing trading - identifying short term (couple of weeks) rebound and/or trend following opportunities.

OUR VALUES

We believe in the concept of "putting the money where the mouth is".

This means we co-invest - the fund manager has placed a significant portion of his own liquid assets into the fund and will continue to maintain a high level of investment.

In addition, we also employ a strictly no performance, no fee approach - we only charge an annual performance fee, and do not charge any management fees.

In fact, this is how we believe every investment fund in the world should be run - seeing investing as a true partnership and fully aligning the interests of the fund manager with that of the clients.

OUR EDGE Using our unique algorithm-based approach has provided results significantly in excess of the Swedish OMX30 index since the first use of our strategy in mid-2015. The algorithms are fully proprietary and totally unrelated to commonly used technical analysis methods. With almost a year of mathematical analysis underpinning the development of our algorithms, they are difficult to replicate by other parties, nor can they be effectively used by large funds due to the active nature of the strategy.

OUR RESULTS Mobilus Scandinavian Focus Fund quarterly performance since its launch on April 1st 2020 is displayed in the table below. The results are shown before the application of fund performance fees, which are deducted annually at the end of each calendar year (or at redemption of fund shares, if this occurs prior to end of the calendar year). We apply the high watermark principle.

| 2020 Q2 | 2020 Q3 | 2020 Q4 | 2021 Q1 | 2021 Q2 | 2021 Q3 | 2021 Q4 |

|---|---|---|---|---|---|---|

| -0.87% | 7.20% | 4.91% | 7.22% | 7.49% | 6.28% | 15.68% |

| 2022 Q1 | 2022 Q2 | 2022 Q3 | 2022 Q4 | 2023 Q1 | 2023 Q2 | 2023 Q3 |

|---|---|---|---|---|---|---|

| -9.05% | -27.87% | 11.19% | 25.69% | 17.68% | 5.15% | -8.68% |

| 2023 Q4 | 2024 Q1 | 2024 Q2 | 2024 Q3 | 2024 Q4 | 2025 Q1 |

|---|---|---|---|---|---|

| 12.82% | -17.83% | -0.37% | 15.86% | -13.83% | -4.77% |

The table here is published on a quarterly basis. Our clients receive monthly reporting.

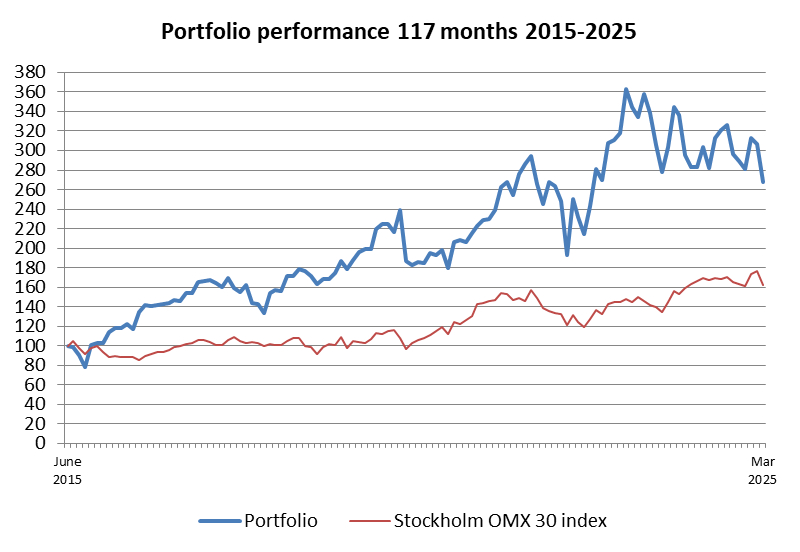

For reference, the performance of our algorithm-based strategy from its very first day of use is displayed in the chart below. From mid-2015 until end of March 2025, in those 9 years and 9 months, our strategy delivered a CAGR of 10.6% which compares very favourably to the 5.1% CAGR delivered by the Swedish OMX30 index during that time.

The below chart is published quarterly.

*note that these results cover the performance of the strategy; for clients, performance fees apply

OUR HISTORY

In 2014, leveraging his 20 years of experience from Swedish stock markets, along with concepts from systems analysis, mathematics and behavioural sciences, Andres P. started developing an algorithm-based predictive model to help explain and forecast short range stock movements.

By mid 2015, the model was completed and validated, and Andres started using it to manage his own personal wealth.

In 2016, Mobilus Fund Management was set up to manage the assets of Mobilus Invest and its daughter companies along with the assets of his family.

In late 2019, based on interest from other potential investors, Mobilus Fund Management applied for a Small Fund Manager licence from the Estonian Financial Supervision Authority. This was granted in early 2020, permitting the company to potentially provide services to other qualified investors as well.

We are now at a stage where we could extend the services from just managing our own family assets to onboarding a small number of additional investors, although we would then seek to keep the circle of investors small and focus on Return-on-Investment rather than being too aggressive in growing the investor base.

"WE DO NOT AIM TO BE THE LARGEST FUND, OR EVEN AN ESPECIALLY LARGE ONE - BUT WE DO AIM TO BE ONE OF THE MOST PROFITABLE ONES AROUND."

MANAGEMENT

The board member for the company is Andres P. who has worked in the banking industry for over 10 years (including Credit Suisse and UBS), and has significant experience in trading Swedish stocks since 1994.

His educational background includes 3 Bachelor's degrees (Business Administration, Systems Analysis and Psychology) from Stockholm University and an MBA from London Business School. You can connect with Andres on LinkedIn (click below).

In addition, the running of our company is supported by the management of our parent company, Mobilus Invest.

DISCLAIMER: THIS WEB PAGE DOES NOT CONSTITUTE AN OFFER TO SELL UNITS IN OUR FUND, SOLICIT CUSTOMER BUSINESS OR SELL OR OTHERWISE PROVIDE FINANCIAL SERVICES AND/OR ADVICE. IT MERELY DESCRIBES THE NATURE OF THE BUSINESS OF MOBILUS FUND MANAGEMENT.

MOBILUS FUND MANAGEMENT IS NOT RESPONSIBLE FOR ANY LOSS ARISING FROM ANY INVESTMENT BASED ON ANY PERCEIVED RECOMMENDATION, FORECAST OR ANY OTHER INFORMATION CONTAINED HERE.

WHEN MAKING INVESTMENT DECISIONS, ONE MUST ALWAYS READ THE TERMS & CONDITIONS OF FINANCIAL SERVICES OFFERED AND DISCUSS WITH A FINANICAL ADVISOR IF NECESSARY

Note on ESG: our algorithm-based investment strategy does not consider ESG criteria; we do not assess any ESG ratings in our investments; nor do we offer any ESG themed products.

Mobilus Fund Management oü. Tallinna 59-6, 71008 Viljandi, Estonia

Commercial registry number: 14097635

Regulated by the Estonian Financial Supervision Authority as a Licensed Small Fund Manager.

Participation by invitation only. Qualified investors only.